ATO Correspondence from SaabTeece

We previously advised that we are implementing some changes to the way we process our Australian Taxation Office (ATO) correspondence.

If you are a client of SaabTeece, this is a reminder that you will receive an email containing a link to your specific ATO documentation. To access the document, you will be required to enter the pin that will be sent to you directly via SMS.

Please ensure that you notify us of any email or mobile number changes so that we can update our records. For overseas clients, the system is enabled to send the SMS to a foreign number.

If you do not receive an email, please be sure to check your ‘Junk’ email inbox. If you do not receive an SMS please get in contact with us.

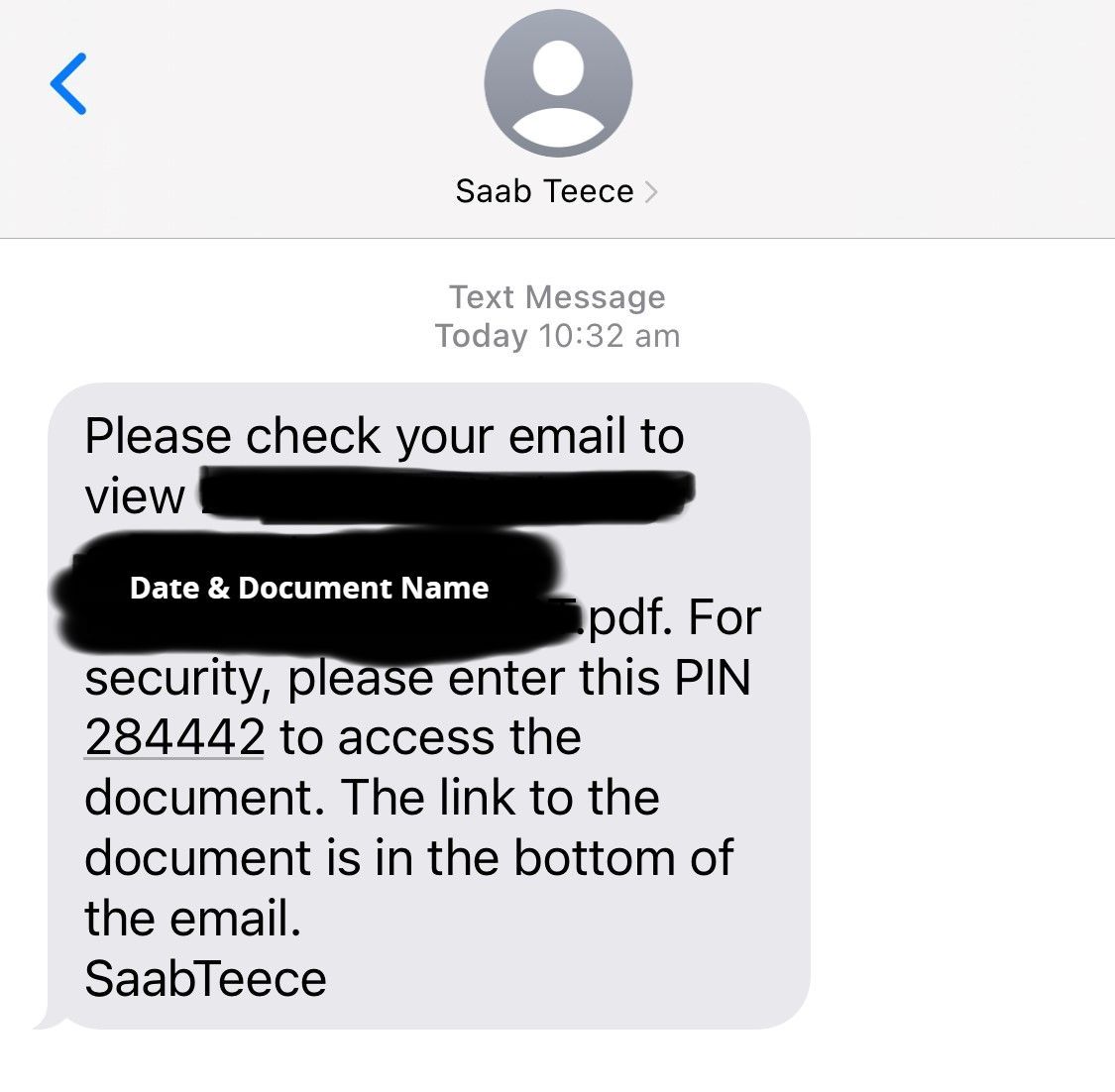

What it will look like

You will receive a SMS that looks like this:

You will also receive an email from "SaabTeece hub.ddslive.center@ddslive.com.au ", please add this email address to your contacts to avoid any emails going to junk or spam.

Note this is a No Reply email address, if you would like to contact us please do so via support@saabteece.com.au

At the bottom of the email there will be a link that looks like this:

When you click the link, a webpage will open for you to enter the pin:

Once you enter the pin the document will automatically download for you to review.

You will also be able to access documents through our Client Portal: Suitefiles Connect. For more information about our Client Portal, please click here.

For now, this change only applies to ATO correspondence. If you have any queries, please do not hesitate to contact Sharon Lee or Justine Vorich.

Recent Posts

SaabTeece

Liability limited by a scheme approved under Professional Standards Legislation.

Shop 2, 17-25 William St, Earlwood, NSW 2206 Australia