It's Tax Time

Happy New Financial Year! It's tax time again!

We are excited to be working with you during the new financial year and looking forward to being partners in your success.

Providing Your Tax Records

You can download our Individual Income Tax Return Checklist here.

Don’t forget that you can upload your tax records to our secure Client Portal. For more information, please click here.

If you don’t yet have access, please contact us.

2024 Tax Lodgement Due Dates:

- Most individuals will have a lodgement due date of 15 May 2025.

- Individuals who had a tax liability of $20,000 or more in 2023 will have a lodgement due date of 31 March 2025.

- If your 2023 tax return was not lodged by 30 June 2024, your 2024 return will have a due date of 31 October 2024.

The Australian Taxation Office (ATO) recommends that you wait until August to commence preparation of your tax return. This should allow for sufficient time for your bank interest, dividend income, Private Health Insurance details and employment income to be reported to the Tax Office, which will mean we shouldn’t need you to provide those details.

Changes to be aware of:

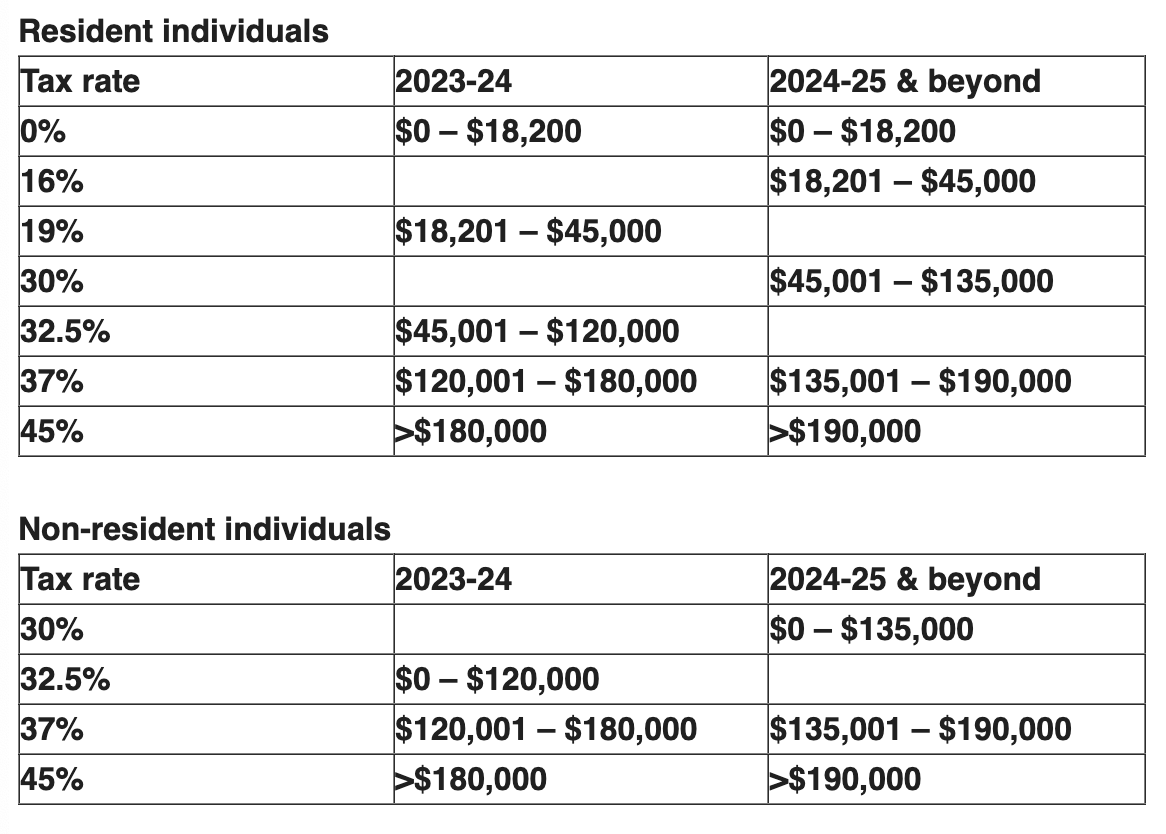

The revised stage 3 tax cuts came into effect on 1 July 2024.

Self-education expense

Item ‘D4 – Work related self-education expense’ now includes education from professional organisations, eg. Seminars from CPA Australia, and not just places of education like universities. You no longer claim them at item ‘D5 – Other work-related expenses’.

Working from Home Calculations

The fixed rate method has increased to 67 cents per hour from 1 July 2022.

The record keeping requirements by the tax office to substantiate working from home deduction claims changed on 1 March 2023.

For more information, please visit our website.

Motor Vehicle Deductions

The cents per kilometre rate has increased to 85 cents per work kilometre travelled from 1 July 2023.

Key Tax Office Focus Areas

Key focus areas in the ATO’s sights are:

Rental property expenses

he ATO is warning rental property owners that their tax returns will be a focus area this tax time. According to the ATO, the “majority” of rental property owners are making errors in their tax returns, despite 86% using a registered tax agent.

The common mistakes highlighted include:

- Repairs and maintenance versus capital expenditure.

- Overclaimed deductions and lacking documentation to substantiate.

- Interest deductions include redrawing or refinance used for private expenses.

- State or Territory stamp duty being claimed as a deduction.

Work-related expenses

Please ensure you do not take a copy and paste approach (from one year to the next) with your work-related expenses. Please ensure you review the expenses you have incurred and ensure you have sufficient records to substantiate your claims.

You can access the ATO’s Fact Sheets on Common Deductions and Record Keeping information here.

Is your side hustle a business?

There are a couple of key considerations when determining if your side hustle is a business:

- Is it a repeated activity – are you regularly engaging?

- Is your intention to make a profit?

If you answer yes to both questions, it’s likely the ATO would consider your side hustle a business, requiring you to have an ABN and report associated income and expenses in your tax return.

Holiday homes and rental properties

The ATO is paying close attention to holiday homes and rental properties. For holiday homes – it is important that all income is reported and that expenses are apportioned between personal and deductible. You cannot claim a deduction for your holiday home during a period it was not available to the public.

With regards to interest deductions against rental properties, it is important to remember that any redraw or refinance on a loan for purposes unrelated to the property will potentially deem that portion of loan interest not deductible.

ATO’s increasing Data Matching

Rental Property Data

The ATO will acquire landlord insurance data from insurers for 2022 to 2026. They will match properties to ATO records for the treatment of rental income, expenses and capital gains risk. This data will include payouts made by insurers that must be reported as income by the taxpayer.

Income Protection Insurance

The ATO will also acquire Income Protection Insurance policy data and match this data with policy payouts and deduction claims.

As always, do not hesitate to contact us.

Kind regards,

SaabTeece

Recent Posts