What's new in Superannuation in 2023

To ensure you remain abreast of any changes and developments in the superannuation space, please make sure you read the following important information.

Reminders

You can see this month’s important dates on our website.

You can also download and customise your own important dates calendar here.

Tax Lodgement Due Dates:

- Most Self-Managed Superannuation Funds (SMSFs) will have a lodgement and payment date of 15 May 2023.

- If your SMSF is newly registered and 2022 will be its first tax lodgement year, lodgement and payment is due by 28 February 2023.

- If you had any returns outstanding as at 30 June 2022, the 2022 return will have a due date of 31 October 2022.

Have you applied for your Director ID as yet?

Does your SMSF have a corporate trustee? All company directors of that trustee must have their Director ID by 30 November 2022. For more information click here.

SMSF with investment in Property

If your SMSF has an investment in a commercial or residential property, please obtain a market appraisal of all investment properties as at 30 June 2022. This appraisal must include comparative values of similar properties recently sold or for sale or it will not be accepted by the SMSF Auditor.

For properties that are leased to related parties, please provide a rental appraisal as at 30 June 2022, including comparative rents for similar properties.

Non-Concessional Contributions

Repealing the work test for voluntary super contributions

From 1 July 2022 the work test has been removed for individuals making non-concessional (after tax) contributions between ages 67-75. Please note the work test is not removed for concessional (tax deductible) contributions.

Downsizer contributions

Downsizing contributions into superannuation

From 1 July 2022 individuals are eligible to use downsizer contributions from age 60 (previously age 65). Downsizer contributions allow eligible individuals to contribute up to $300,000 from the proceeds of the sale of their home into superannuation.

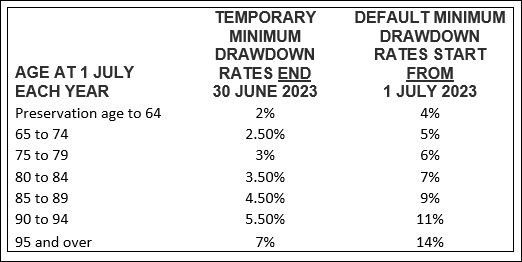

Pensions

The temporary reduction of the minimum pension payments has been extended for the 2022-2023 financial year.

Covid-19 Relief for SMSF trustees ended on 30 June

Our COVID-19 relief for SMSF trustees ended 30 June 2022

Support offered by the ATO for SMSFs impacted by Covid-19 ended on 30 June 2022. These measures included:

- SMSF residency relief.

- rental relief (including rental reduction, waiver and deferral relief).

- loan repayment relief, including for limited recourse borrowing arrangements.

- in-house asset relief.

How much do you need to save for your Retirement?

How much do you need to save for your retirement?

Super Consumers Australia recently released detailed research outlining new retirement savings targets for homeowners. The data is designed to help Australians get started on their retirement plan and help answer the questions of how much they need to save to retire. For more information please click here

If you would like assistance with your retirement plan, please don’t hesitate to contact ST Wealth.

Recent Posts

SaabTeece

Liability limited by a scheme approved under Professional Standards Legislation.

Shop 2, 17-25 William St, Earlwood, NSW 2206 Australia