Overdue Invoices

At SaabTeece we love our technology and we wanted to inform you of a change we are making to our fee collections process.

If you have an invoice issued by us that falls 10 days overdue, our collections system will send you an automated SMS. You will continue to receive a SMS every 10 days until the invoice is paid in full.

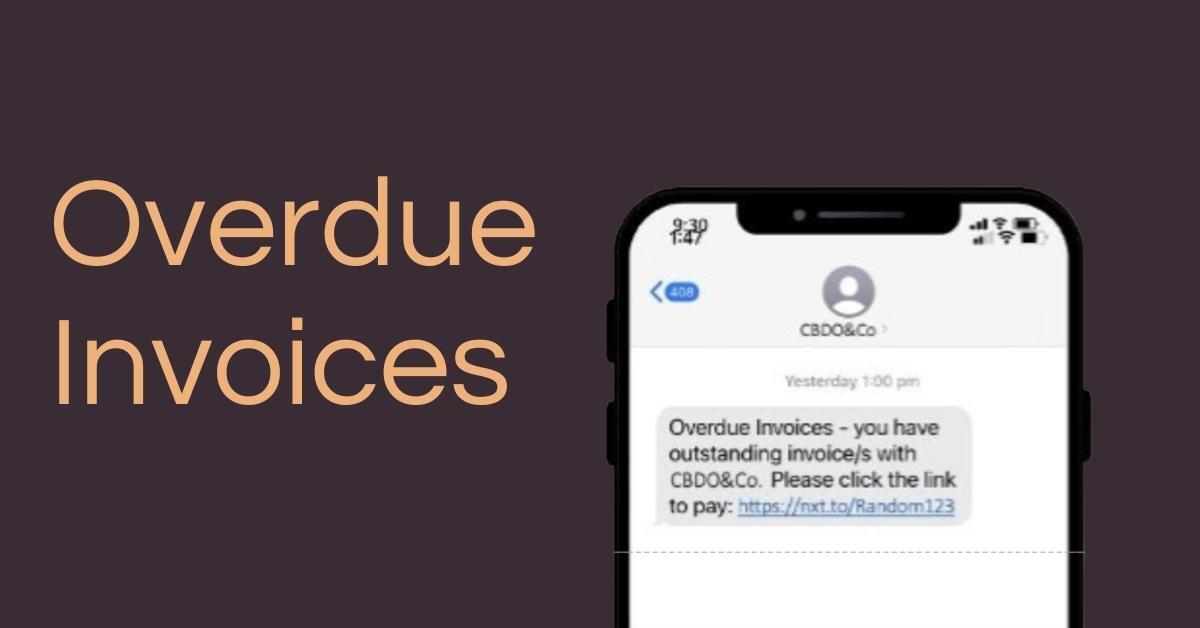

The SMS will look like the image above, however, it will say from SaabTeece. When you click the link, it will take you to a secure portal where it will list the outstanding invoice/s and provide you with payment options.

If you would like to confirm the validity of the SMS, check your email. You will receive an email (detailing the overdue invoice/s) a few hours before the SMS is sent. Note that you may have elected someone else to receive accounts emails from SaabTeece.

Should you have any questions, as always, please do not hesitate to

contact us.

Recent Posts

SaabTeece

Liability limited by a scheme approved under Professional Standards Legislation.

Shop 2, 17-25 William St, Earlwood, NSW 2206 Australia