Property Development Structure with Two Investors | Case Study

The Situation

A client and his long-time friend decided to come together to undertake a property development project. They came to SaabTeece for advice on how the property development should be structured.

The Facts

- The intention from the beginning was to build and sell with a profit-making purpose.

- One of the two ‘developers’ holds a building licence.

- They will engage a builder to undertake the construction of the project.

- Both ‘developers’ have previously engaged in property development activities in the past.

- Whilst both ‘developers’ have the intention of building to sell, they want to ensure they have flexibility in how each of their potential profit is distributed.

- Each ‘developer’ already has a family trust with a corporate trustee that they use for investing purposes.

The Solution

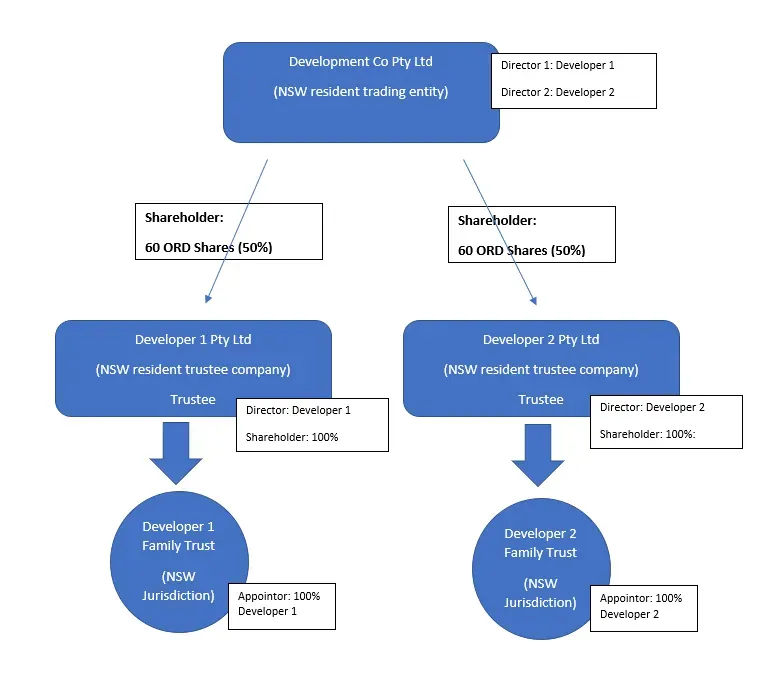

- Establish a new company to conduct the property development in.

- This new company will have each developer’s respective family trust as shareholder.

- Profit of the development will be taxed in the company at 25%.

- The taxed profit will be paid equally to each shareholder as a franked dividend.

- Each developer then has the flexibility to decide, based on their own family situation, how the franked dividend is distributed to the beneficiaries of their respective family trust.

The Structure

This case study provided here is intended for general informational purposes only. It is not intended as legal, financial, or professional advice specific to your individual circumstances. The information presented in this case study is of a general nature and may not apply to your unique situation.

We strongly advise that you seek advice tailored to your particular needs and circumstances. Your specific situation may not be adequately addressed by the general information contained in this case study.

Any actions or decisions taken based on the information in this case study are solely at your own risk. Our accounting firm, its employees, and representatives shall not be held responsible for any consequences resulting from your reliance on this case study without seeking individualised professional advice.

Recent Posts