Oct 2022-23 Federal Budget Summary

To a backdrop of inflation at a 32-year high, a global pandemic, natural disasters and an energy crisis, the focus of the Federal Government’s budget was on everyday Australians. The Albanese Government has delivered their first Budget, however, please remember that legislation must be passed before any of these measures are law.

Below we have highlighted some of the key budget measures we believe are relevant for our clients. For more detail on any of the budget measures announced please visit the Government’s website.

Fringe Benefits Tax (FBT) Exemption for Electric Vehicles

- Will apply to battery, hydrogen fuel cell & plug-in hybrid electric cars.

- Purchase price must be below the Luxury Car Tax limit for fuel efficient cars (currently $84,916).

- To apply from 1 July 2022.

Energy Efficiency Grants for Small to Medium Enterprises (SME)

- Grants to help SME businesses fund energy efficient equipment upgrades.

- $62.6M over 3 years (2022-23).

- No further details available at this time.

Increase Funding for Tax Compliance Programs

- The Australian Taxation Office (ATO) will receive an additional $200M per year over 4 years.

- Aim of compliance programs is to detect tax avoidance.

- We expect that this will result in additional audit activity for businesses, high net wealth groups and individuals along with anyone reporting rental income.

Have you taken out Audit Shield? In the event that you are subject to an audit; the associated professional fees (to a set limit) will be covered. Please contact us if you would like a pro-rated invoice or more information on Audit Shield.

Changes to Tax Treatment for Off Market Share Buy-backs

- Aim is to align the tax treatment of off-market share buy-backs undertaken by listed companies with the tax treatment of on-market share buy-backs.

- Under current rules, part of the proceeds of an off-market share buy-back is treated as a dividend, potentially with franking credits attached.

- Off-market share buy-backs, under their current tax treatment potentially advantage low-taxed shareholders (such as some individuals and superannuation funds, including SMSFs).

Senior Australians

Increased Income threshold per annum for Commonwealth Seniors Health Card

| Current Threshold | New Threshold | |

|---|---|---|

| Singles | $61,284 | $90,000 |

| Couples (Combined) | $98,054 | $144,000 |

Income Support Recipients Asset Test Extended on Proceeds of Sale of Main Residence

- Assets test exemption for proceeds from principal home to be extended from 12 to 24 months.

- A lower deeming rate (0.25% to apply to the principal home sale proceeds for 24 months after the sale of the home).

Incentivising Pensioners into the Workforce

- Age pensioners will be able to earn an additional $4,000 before their pension is reduced.

Child Care

- Child Care Subsidy (CCS) rate to increase from 85% to 90% for families earning less than $80,000.

- Subsidy rates will taper by 1% for each $5,000 the family earns.

- CCS will cut out when families earn $530,000 or more.

Paid Parental Leave

- From 1 July 2023 families will have the flexibility to choose which parent takes leave.

- Eligibility will also be expanded with an introduction of a $350,000 family income test.

- Amount of leave provided under the scheme will be expanded:

| Financial Year | Weeks of Leave |

|---|---|

| 2023-24 | 20 |

| 2024-25 | 22 |

| 2025-26 | 24 |

| 2026-27 | 26 |

Previously Announced Measures

The following policies that were presented by the Morrison Government in May have been confirmed by the Albanese Government, however we await legislation:

- 120% boost for investment in digitalisation.

- 120% boost for investment in education.

- Reducing the Downsizer eligibility age to 55 years.

- Relaxation of residency rules for Self-Managed Superannuation Funds (SMSFs).

We will provide additional information when any of the above measures are legislated.

As always, do not hesitate to contact us if you have any questions.

Kind regards,

SaabTeece

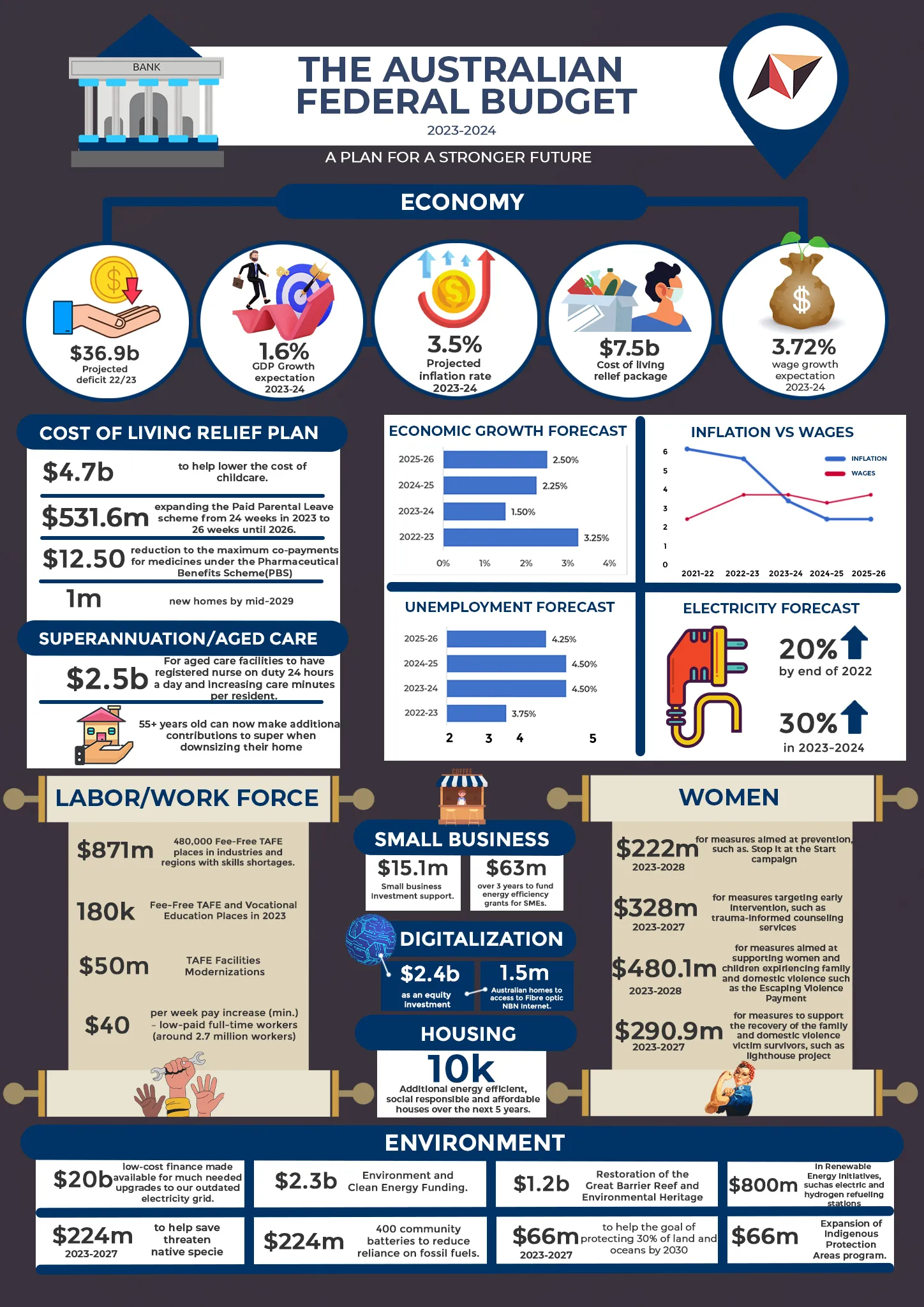

Federal Budget Summary Infographic

Recent Posts

SaabTeece

Liability limited by a scheme approved under Professional Standards Legislation.

Shop 2, 17-25 William St, Earlwood, NSW 2206 Australia